Global cell solutions.

Artex Axcell facilities are available in multiple jurisdictions around the globe, including Guernsey, Bermuda, Cayman and the United States. Our client-centered approach combines international experience with local market expertise, allowing us to deliver a plug-and-play solution that capitalizes on our global access and local insight.

We currently manage over 1,300 individual cells for all sizes of business — from small-scale operations to multi-national organizations that encompass a wide range of industry sectors.

At Artex, we compare the costs and benefits of operating a cell against the costs and benefits of other alternatives for the efficient transfer of risk. The cell solutions we design are based on each customer's individual risk profile, ensuring that our strategies are aligned with each organization's requirements. The flexibility of these structures also enables us to be responsive to changing market conditions and organizational dynamics.

Cell facilities overview.

Cell facilities — also known as cell captives — have been one of the most important evolutions in the captive insurance and insurance-linked securities spaces, and have become an integral component of the self-insurance market in many of the established captive domiciles. These plug-and play cellular insurance and (re)insurance solutions ensure the benefits associated with captive insurance ownership are available to organizations of all sizes.

Many terms are used to describe cell facilities, with most related to the domicile classification. These terms include protected cell company (PCC), segregated account company (SAC), segregated portfolio company (SPC), portfolio insurance company (PIC), sponsored captives, cell captives and more.

Through the combination of our Artex-sponsored and client-sponsored cell companies, Artex is a global leader in the formation and management of cell facilities. Our highly experienced teams provide service support for the lifecycle of the structure — from the initial feasibility study through formation and ongoing management. Moreover, we offer domicile neutrality and complete independence throughout, unencumbered by ties to specific domiciles or territories. Our focus is solely our client's business objectives.

Structure and uses of cell facilities.

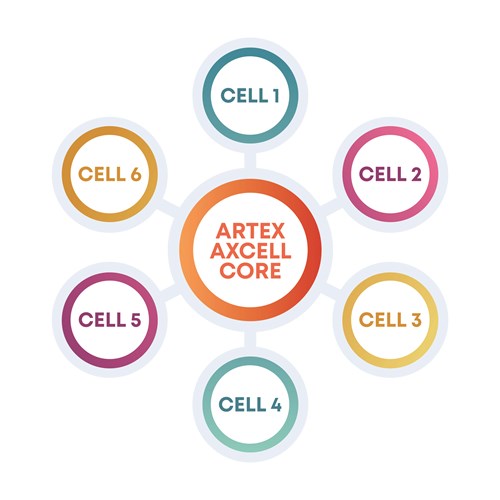

Cell facilities enable multiple users to operate different risk transfer activities through a single legal entity. Each cell operates in the same manner as a traditional captive insurance company, but can be more efficient in speed of setup, operating costs and exit costs. This efficiency means that each cell can also act as a special-purpose vehicle with a single objective for a specified duration.

The assets and liabilities of each cell are segregated and protected from those of the other cells, both by statute and by contract.

Each facility issues two classes of shares:

- Core

- Cellular

Artex, as the licensed insurance Manager, provides all of the services required to operate the cell under the supervision of the board of directors of the cell company.

Cell facilities can be used for a variety of purposes, including as a stepping stone to full captive ownership, to gain greater (re)insurance market access, provide flexibility in coverage, fill gaps in commercial policies, create new revenue streams, act as a transformer vehicle to facilitate the transfer of insurance risk to the capital markets and as a captive exit strategy.